All Categories

Featured

Table of Contents

[/image][=video]

[/video]

The accredited life insurance policy representative is D. N. Ogle (Arkansas # 17009138, California # 0L37586). The AARP Life Insurance policy Program is financed by New York Life Insurance Coverage Firm, New York, NY 10010 (NAIC # 66915).

New York Life Insurance policy Business is accredited in all 50 states. There are various other products offered under the Program that have different expenses, advantage quantities, insurance coverage lengths, underwriting, and other features like chronic health problem acceleration.

How No Medical Exam Life Insurance Sproutt Vs Mintco Financial can Save You Time, Stress, and Money.

These charges are utilized for the general functions of AARP. AARP and its associates are not insurance companies and do not utilize or support representatives, manufacturers, or brokers. AARP has actually established the AARP Life Insurance coverage Depend on to hold team life insurance policy plans for the benefit of AARP participants. Full conditions are established forth in the team plan released by New York Life to the Trustee of the AARP Life Insurance Coverage Trust Fund.

Our firm can use up to to virtually anybody that is functioning at the very least 20 hours a week. If you have actually been decreased for insurance coverage in the past, this could be your only choice for life insurance protection without a waiting period.

The policy also supplies optional cyclists for spouses and children. You can insure your spouse for approximately $30,000 and your kids, aged 26 or more youthful, for up to $20,000. While no added needs are needed to qualify for this protection, it does enhance the expense compared to a single-person policy.

Aig Direct Life Insurance Things To Know Before You Buy

Provide us a phone call today and we'll assist you start. In the table below we have actually given some example prices by age and gender for $50,000 of ensured concern life insurance policy without a waiting period. If you buy one on these plans, your household or enjoyed ones will certainly be secured as soon as you make your initial settlement.

If these rates do not fit your budget, we'll help you find the best plan for your demands. We can provide as little as $10,000 or as high as $75,000 of instant surefire life insurance policy protection without any kind of wellness info. To get a precise quote, click in the kind below, or call us toll-free at.

No medical examination is required for an approval and the insurance supplier will not assess your medical records. You are ensured to be accepted. The compromise with assured life insurance policy policies is that they do not use full insurance coverage for two-years. This indicates that if you pass away from any health-related concern throughout this moment, your family will not receive the complete survivor benefit from your life insurance policy policy.

No waiting period called for. Your plan begins as quickly as you make your initial payment. Toll-Free: Most life insurance policy service providers will certainly not provide guaranteed approval life insurance policy to candidates that under the age of 40. Our agency can provide as long as $75,000 of coverage to practically any individual over the age of 18 if they are currently working at least 20 hours a week.

Examine This Report on Get Accepted For Guaranteed Issue Life Insurance

Written by: Cliff is a qualified life insurance coverage representative and one of the proprietors of JRC Insurance coverage Team. He has aided thousands of family members of services with their life insurance needs since 2012 and specializes with applicants that are much less than excellent health and wellness.

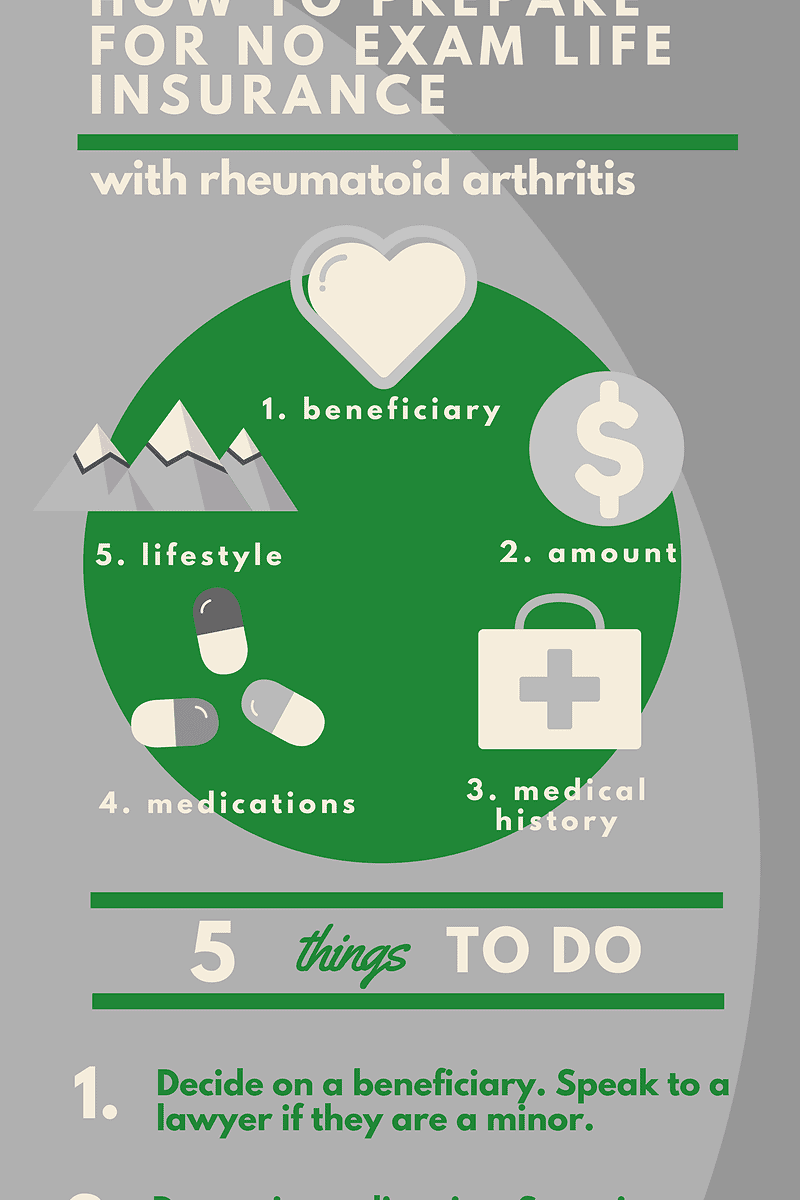

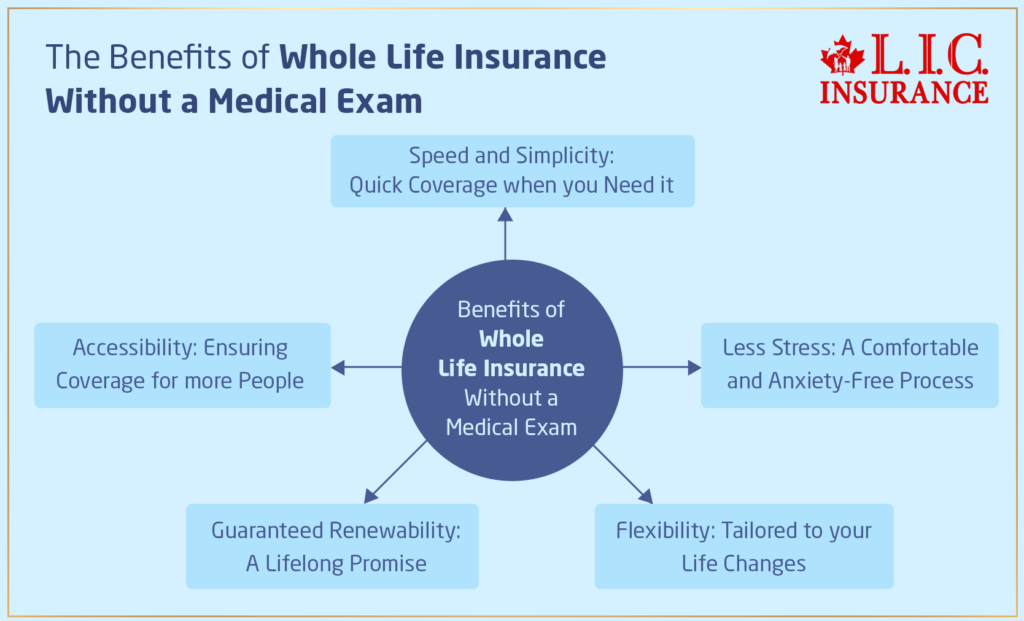

In this post, we'll respond to the most often asked questions regarding life insurance policy, no medical exam.: No medical examination life insurance policy consists of term and entire life alternatives, with term being more budget-friendly and entire life offering long-lasting coverage.: Insurance providers manage threat in no exam policies by charging higher costs or using different health and wellness information resources.

It's vital to keep in mind, however, that the survivor benefit is just payable if the insurance policy holder passes away within the term. Term life insurance policy is also eye-catching for elders concentrating on long-lasting preparation. Choosing term life insurance policy without a medical examination can be beneficial, specifically if you have a clear idea of your coverage duration.

The smart Trick of Best No Exam Life Insurance Companies Of 2025 That Nobody is Discussing

Choosing whole life insurance coverage without a medical examination streamlines the process and offers sustaining support. Understanding the Infinite Financial Principle and Just How It Works In Our Modern Setting 31-page e-book from McFie Insurance Order here > Insurance provider are truly excellent at handling threat. They examine wellness and way of life information on each applicant and utilize this information to determine what quantity of premium will be required in order for the policy to be issued.

Latest Posts

What Does Term Life Insurance Do?

What Does Cheap Life Insurance Without Medical Exams In 2025 (Top ... Do?

Get A Free Quote - Aarp Life Insurance From New York Life - Truths